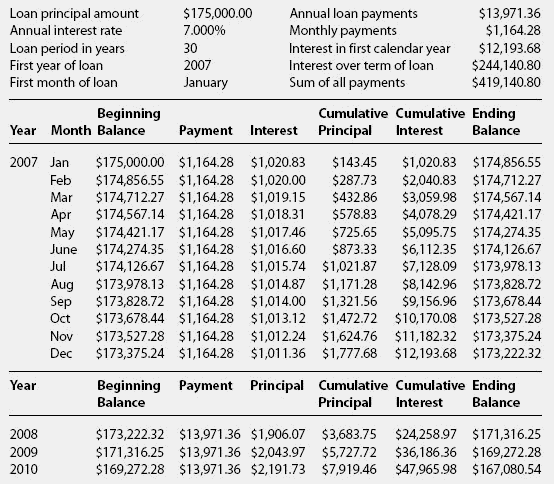

This will provide the lender with the following: You only pay off a small piece of the principle amount.Īs time goes on, more and more of each payment goes towards your principal (and you pay less in interest each month).Īmortizing a loan usually means establishing a series of equal monthly payments. Especially with long-term loans, the majority of each periodic payment is taken as an interest expense. Generally, your interest costs are at their highest at the beginning of the loan. With each monthly/quarterly payments a portion of the money goes to the principal amount and the other to interest amounts.

In simple terms, Amortization happens when you pay off a debt over time with regular, equal payments. Although you can not load two or more sets of data on one sheet, it is a helpful worksheet for those trying to keep track of their amortization.As per Wiki – “In banking and finance, an amortizing loan is a loan where the principal of the loan is paid down over the life of the loan (that is, amortized) according to an amortization schedule, typically through equal payments.”

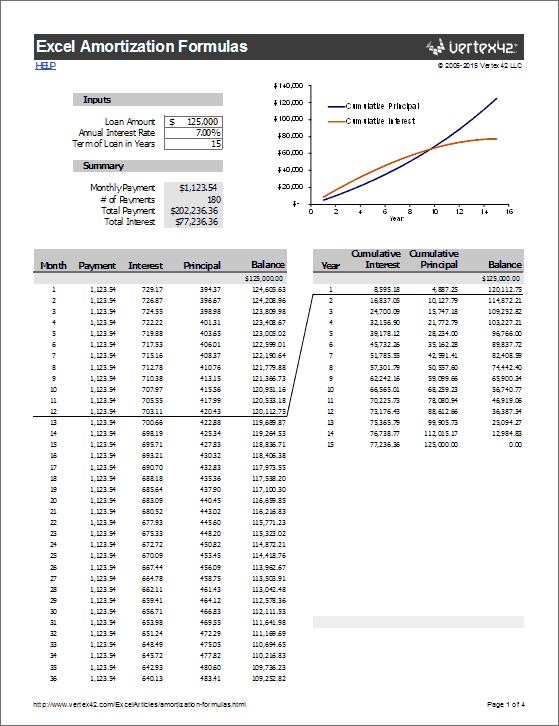

Any amount above the payment due is used to pay off the principal, and the Payment worksheet reflects this. Users would use this sheet if they are going to pay more than the required monthly payment.

A second spreadsheet, titled Payment, provides an alternative way to record payments. For example, if you hover your mouse over the Additional Payments cell, an explanation of its function will pop up. Below the loan information and summary is the amortization schedule, which is displayed clearly for the user.Ĭertain cells in the sheet show red flags if you hover over these cells, you will get an explanation of what each cell represents. A summary is provided about your information, including the rate, number of payments, total payments and estimated interest savings. After you input your loan information, the spreadsheet calculates your monthly payment. It can complete an amortization schedule for any type of loan. The worksheet is formatted with built-in formulas, so all you have to do is put in your loan information. The Loan Amortization Schedule worksheet for Excel is a tool used for loan calculations.

0 kommentar(er)

0 kommentar(er)